The aftermath of the 2008 Great Recession

October 22, 2018

It has been one decade since the crash of the stock market in September 2008. Although the crash of the economy happened 10 years ago, there are still people who are recovering from the events that happened, including students at West Texas A&M University.

“Although I am graduating from college soon with a full-time job waiting for me, I still only would make enough to maintain a car payment and to pay rent. I also have to think about how I will pay for my student loans, and this gives me more stress than anything,” said Ben Ulloa, senior biochemistry major at WTAMU.

The Dow Jones Industrial Average dropped 777.68 points on Sept. 29, 2008. This meant that the value of various companies decreased exponentially in a short amount of time. This includes AIG, an insurance company, Lehman Brothers, a global finances firm, and Washington Mutual, a savings bank holding company. All three of these companies filed for bankruptcy, bankruptcy law was not the same back then, Washington Mutual was not able to get back up and it is not in business anymore because of the fall of the economy.

“The Dow bounced around 11,000 [points] until Sept. 29, when the Senate voted against the bailout bill,” said thebalance.com, in a story about the stock market crash. “The Dow fell 777.68 points, the most in any single day in history.”

The bailout bill was an act that was going to be used to help businesses from failing. By using the bailout bill, or the Emergency Economic Stabilization Act, it would clear the debts, pensions, and hedge funds from the history books in businesses.

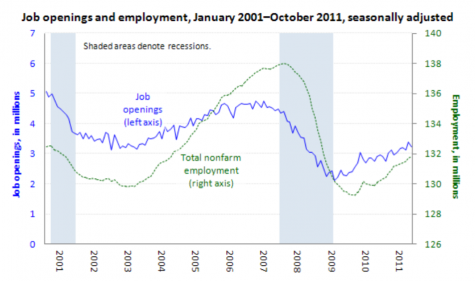

Many people found themselves without a job and without a way to provide for their families. The Bureau of Labor Statistics shows that before the Great Recession, the unemployment rate was at 5 percent, but in June 2009, it was at 9.1 percent. It peaked at 10 percent in October 2009. Others had invested in stocks, and when the points fell in the Dow, their stocks dropped in their value. On the other hand, there were those who were not affected greatly by the decline in stocks.

“From late 2007 to early 2010, payroll jobs would decrease by about 8.7 million, sending the jobless rate to a 10 percent peak,” said National Public Radio in a story that featured the 10-year anniversary of the Great Recession.

Although the stock market has had time to recover, people still feel the effects. The wages are not being increased to follow the rise of prices in stores and with the housing market. The market is not much different than it was before the collapse.

“Despite almost ten years of economic growth, real wages are stuck at their pre-crisis level, while corporate profits are soaring and stock prices have reached record highs. All the misshapen economic trends of the previous decade are still with us,” said The New Yorker, with a story that recapped the beginning of 2008 and the downfall of the stock market.

The economy has not fully recovered, but neither have some people who went through the turmoil of losing retirement savings, losing their house, and being let go from their job. Many invested their savings into the stock market in an attempt to earn more money as the market seemed to be on the incline.

“Take Karen Moyers, 58, of Conroe, Texas. After building up her savings in the hairdressing business, she lost nearly all of it in an investment fund managed by a financial advisor during the crash. Now, she is working in a jewelry store for lower wages than she once made and only has enough savings to live on for about a year should she lose her job,” said CNN.

The stock market has been on the rise, but there are parts that still are in the recovery phase since the Great Recession. This includes the housing market being at an all-time high, but the wages being the same as before the crash. This can be a hindrance to young people who are looking to buy a house after graduating college. People can now start to have faith in the stock market by beginning on low-risk investments which can be found on https://www.stocktrades.ca/.