Tips for money management in college

Money. It makes the world go round. The key, however, is managing your money in a way that keeps your life going the way you want it to. For college students whose time is split between studying and making enough money to pay for their education, money management can seem particularly difficult.

Managing your money does not have to be difficult, but it does take some planning. One of the best ways to start managing your money is through creating a budget for yourself. A budget may seem more stressful than “winging” your finances, but it causes far less stress in the long run. Buying that new iPhone may seem like a good idea in the moment, but what about when you need an unexpected car repair and are left with no money until your next paycheck?

Budgets can sound restricting, but, the truth is, you are in control of your own budget. Sure, there are general guidelines and goals you may want to adopt, but you can customize your budget to fit your own expenses, goals and life.

One lesson that everyone has to learn is the importance of setting priorities.

According to The Balance, “You can’t purchase everything. Every decision requires a trade-off. Creating a budget helps you think more deeply about which trade-offs you’re willing to make.”

Just as it is important to budget your time, it is equally important to budget your money. If you spend all your time partying, how do you expect to keep your grades up? Likewise, if you spend all your money on items you do not really need, how will you have enough money for the things you do?

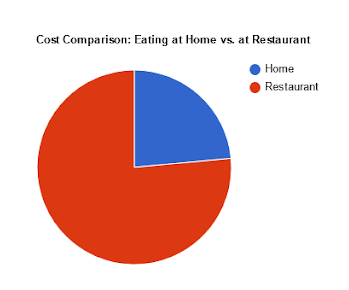

One expense that many college students overspend on is food. Everyone needs food to survive, but eating out all the time can really add up. It may seem more convenient to have someone else make all your food for you, but there are simple items that can be bought at the grocery store and made into a quick meal for a fraction of the cost.

According to Money Under 30, the average commercially-prepared meal costs around $13, while the average meal prepared at home costs around $4 for groceries. This means that a restaurant meal is about 325% more expensive than a meal you prepare yourself.

This is not to say that you should never eat out, but it is something to be aware of. If you make a budget that includes a certain amount of money each week or month for food, you can decide how often you can afford to eat out.

The great thing about budgeting is that it helps you reach your financial goals more efficiently. Saving is important for unexpected emergencies like losing your job or ending up in the hospital. However, it is also important for being able to afford a new car or your dream vacation.

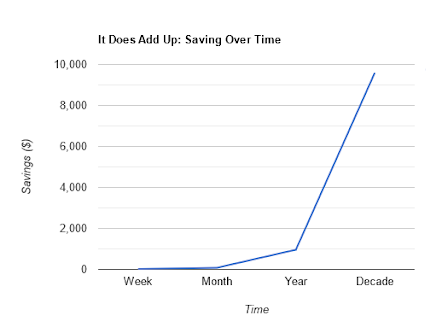

Even saving a small amount of money adds up over time.

This graph is just one example of the financial gains that can be made by setting aside some money for saving each week. If you were to save $20 each week, that would add up to about $80 in a month, $960 in a year and $9,600 in ten years.

“Just save because, no matter what happens, at least you’ll be prepared one way or another,” said Jessie Castillo, senior business management major at West Texas A&M University and peer financial coach with Education Credit Union Buff $mart. “By saving or accumulating money, you can save for any goals or dreams you may have in the future.”

The Education Credit Union Buff $mart program at WTAMU provides tools, resources and financial education for students to graduate with less debt and become financially independent. ECU Buff $mart provides one-on-one coaching sessions in person or via Webinar for students for any financial topics they want to discuss. These sessions can range from a generalized info session about finances and budgeting, talking about topics such as scholarships or employment or help with a specific financial goal or challenge. To schedule a session, send an email to [email protected].

Buff $mart offers a variety of workshops and events for students each semester.

Follow Buff $mart on Instagram (@wtbuffsmart) and Facebook (Education Credit Union Buff $mart Program) to learn financial tips and find out about upcoming events!

My name is Hannah Valencia. I am a senior strategic communication major from Santa Rosa, California. I love to write! My favorite part of working with...