College is less affordable than ever

The cost of college has gone up in the past 50 years, just as the cost of everything else has gone up. However, the cost of college in proportion to the federal minimum wage is far off balance. College is more unaffordable than ever and it’s only getting worse.

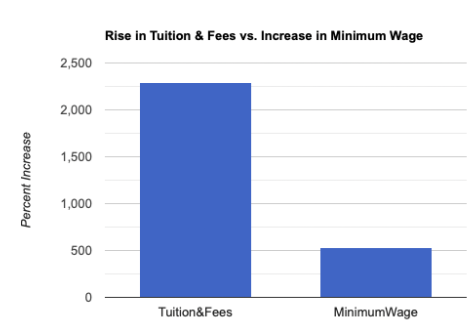

According to the National Center for Education Statistics, for the 1968-69 academic year, the average in-state tuition and fees for one year at a public, non-profit, four-year university was $683. By the 2018-19 academic year, that amount jumped to $16,318, an increase of 2,289 percent.

Between 1968 and 2018, the federal minimum wage rose from $1.15 per hour to $7.25 per hour, representing an increase of 530 percent. Although this increase in minimum wage is substantial, it is not enough to meet the 2,289 percent increase in university tuition and fees.

Currently, 29 states have a minimum wage that exceeds the federal minimum. This means that 42 percent of states have a minimum wage of $7.25 an hour, but 58 percent have a higher minimum wage.

As of 2022, Washington has the highest state minimum wage at $14.49 per hour, about 100 percent higher than the federal minimum wage.

If the 1968 federal minimum wage is compared to the highest state minimum wage of $14.49, the percent increase is 1,160 percent. While much better than the statistics when comparing the federal wage between then and now, this higher state wage still only meets 51 percent of the increase in tuition and fees over the past five decades.

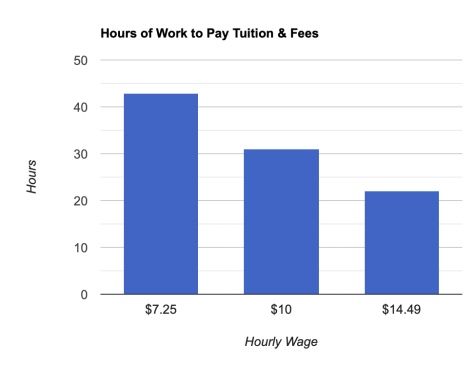

While students in 1968 could afford their tuition and fees with just 11 hours of work each week of the year, students in 2018 would have to work 43 hours a week at the federal minimum wage. At the highest state minimum wage as of 2022 ($14.49), students would have to work 22 hours each week to pay for tuition and fees, but that does not account for inflation in tuition and fees between 2019 and 2022.

Although around 20 hours of work a week to pay for tuition and fees does not seem unmanageable, 42 percent of states still use the federal minimum wage, which doubles that weekly work requirement to around 43 hours. In addition, the majority of states do not have a minimum wage as high as $14.49.

The average state minimum wage as of 2022 is $10 an hour. Again, not adjusting for inflation in tuition and fees in the past three years, a college student would have to work 31 hours a week to pay for tuition and fees.

A college student now has to work two to four times as many hours to pay for tuition and fees as they did 50 years ago. In addition, the cost of tuition and fees does not account for a student’s living expenses, or the cost of textbooks and other academic supplies.

For full-time college students, having a full-time job on top of their studies is just not feasible. Working over 20 hours a week while being a full-time student is one likely way to tank your GPA.

Students are forced to decide between slowing down their studies to part time while they take on more hours at work or taking out loans. As of 2020, the average student loan debt for recent college graduates is about $30,000. Average student loan debt has increased by about 20 percent in the last decade.

These statistics are not encouraging for future college students. While students were once able to afford their tuition and fees with a part time job, this is often not the case today. Higher education is becoming more financially unattainable for young people. The issue does not have one source, either.

The problem is a combination of low minimum wage and inflation in college tuition and fees. The result: Young people are increasingly overworked and forced to go into debt, getting farther and farther away from financial stability.