Budget yourself and graduate debt-free

As college costs increase, getting a degree without getting into huge amounts of student debt could seem challenging. Planning ahead can help manage and reduce student debt.

On Oct. 1, the Free Application for Federal Student Aid opened for the 2023-2024 academic year. Students can qualify for federal and state grants depending on income, but they won’t cover most of it. For many, FAFSA helps pay for most college tuition. For others, scholarships grants might not be enough and they have to find other solutions to help pay for college.

Scholarships

Students should start applying for scholarships as soon as possible. The West Texas A&M University scholarship application is open until Feb. 1st. for current and new students. WT awards about $5 million yearly with an average of about $1,200 per student.

“Every scholarship matters,” said Michael Rogers, a junior agriculture major. “I don’t want to spend the rest of my life paying off my college tuition.”

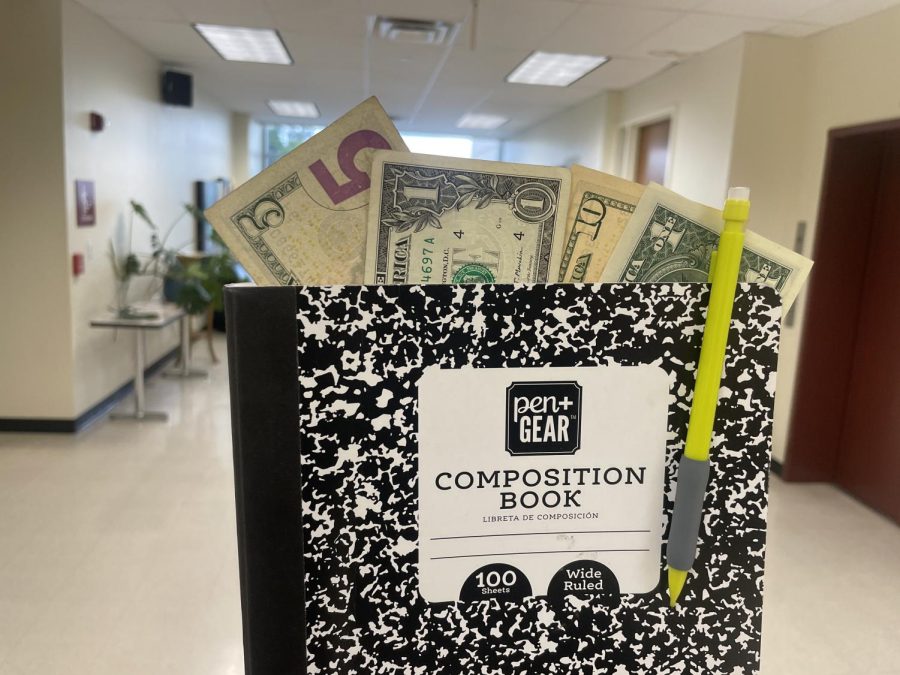

Budget yourself

Set a budget for how much you spend a month. Make sure to create a list of what you spend like essentials, utilities, groceries and subscriptions. Add up the costs and adjust any spending that can be reduced or removed. Cut off any subscription service you are no longer using. If you’re planning on a big purchase or saving for loan payments in the future, start putting money into a savings account. It could be as little as $20 a week.

“I currently work part-time while attending school,” said Russell Villarreal, a junior general studies major. “I’m planning on buying a new car, and budgeting myself is important as a college student.”

Rent your textbooks

College students typically buy new textbooks through the campus bookstore. Companies like Amazon and Chegg rent used textbooks to students, saving students up to 90% for a much more affordable price. The only catch is students must return them before they charge you for the book.

“I typically only rent textbooks,” said Denise Rodriguez, a freshman nursing major. “The only time I buy is if it’s unavailable or made executive for the class.”

Part-time job on campus

Many students have part-time retail or restaurant jobs and a college schedule. According to College Reality Check, most full-time students work 10-20 hours. The benefit of working a part-time job is having good time management. WT students can look for part-time jobs on Handshake.

Hello, my name is Blass Guerrero, and I’m from Dumas, Texas. I am currently a senior as a broadcast journalism major. I like to work out, hang out with...