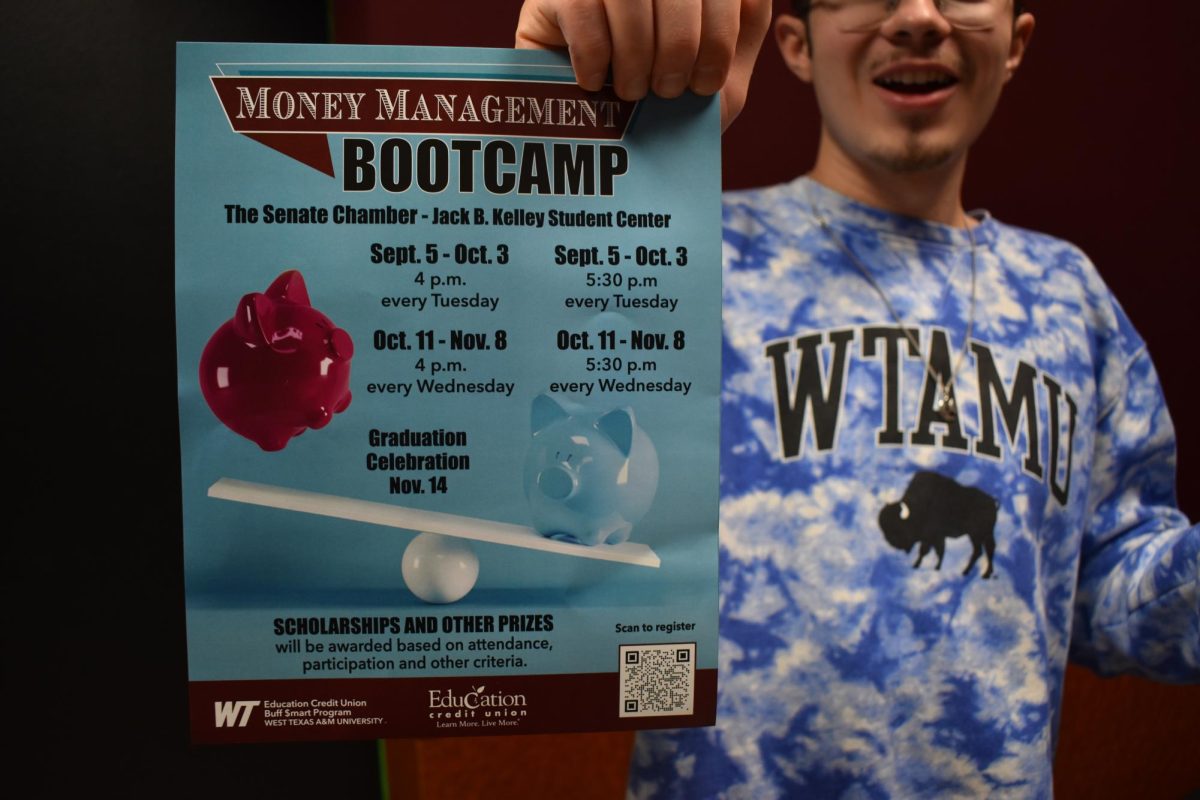

Money Management Bootcamp begins Sept. 5 in the Senate Chamber at the Jack B. Kelley Student Center. This six-week financial education course offers four sections: Tuesday sessions at 4:00 p.m. or 5:30 p.m., and Wednesday sessions that begin Oct. 11. Each session is one hour, and the bootcamp is presented by the Education Credit Union Buff $mart Program.

The bootcamp covers paying for college, credit, overcoming financial obstacles, budgeting and savings. Colten Hibbs, an Education Credit Union financial educator, instructs the course and said that a comfortable shared learning space is important to facilitate open conversations about money.

“Nobody wants to feel talked down to, so you’re just reaching people where they are and just having a conversation,” Hibbs said. “I really, strongly believe too many people are afraid to have conversations about money, and given its level of importance and impact on our daily lives, we should probably be more comfortable.”

Tucker Gattis, a public administration graduate student, completed the bootcamp in the fall of 2020. Gattis said Hibbs always “keeps things upbeat.”

“Bootcamp is not meant to be boring,” Gattis said. “It is not a drag. I actually looked forward [to] going to it every day.”

Attendance, participation and completing assignments earn students points throughout the bootcamp. Graduates with enough points earn a chance to win a $250 scholarship. These assignments include setting a budget and attending a session with a peer financial coach.

“When a student comes in for a peer financial, or a one-on-one coaching session is what we call that, [it] is open to them to decide what they would like to talk about,” Niquole Knapp, a peer financial coach and graduate of the bootcamp, said. “And the options are kind of endless.”

The graduation celebration on Nov. 14 includes dinner, a certificate of completion and the scholarship drawing.

“That was actually the original reason I signed up for bootcamp was to get to see people, but also because I was hoping for that scholarship,” Gattis said. “But it turns out I was taking away a lot more than just that scholarship at the end.”

Meghan Williams, Buff $mart program director, said that the financial education the bootcamp offers may also ease students’ stress levels.

“Having a good grasp on how to manage your money and that kind of thing, that you’re less stressed overall,” Williams said. “Especially most students are working part-time jobs and trying to pay for college, and college is a lot more expensive than it used to be.”

For more information and to register for the bootcamp, visit the Buff $mart website.